Blog

Super Bull Market Returns? Arthur Hayes Predicts BTC Will Reach $110,000 Soon

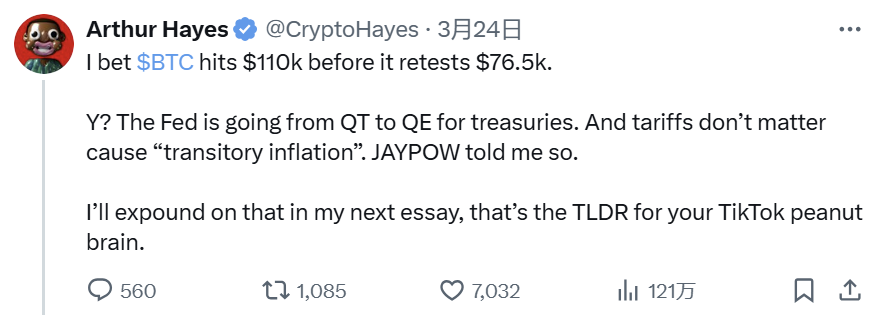

On March 24th, Arthur Hayes, the founder of BitMex, made the latest remarks on BTC, predicting that BTC will soon reach $110,000. Arthur Hayes is one of the most well-known cryptocurrency investors globally. He often makes public predictions about the short-term or medium-term price trends of BTC and has a relatively higher accuracy rate compared to other individuals or institutions.

Last time, we discussed that BTC is currently in the middle of a bull market. Not only does Arthur Hayes’ prediction align with this assessment, but many signs also indicate that the BTC market is warming up and trending upward. According to data from SoSoValue, on March 26th, the total net inflow of Bitcoin spot ETFs was $89.57 million, with continuous net inflows for nine days. The current price of BTC is around $88,000.

The head of digital asset research at Standard Chartered Bank also stated this week that BTC is likely to rise further in the short term. In his latest research, he also believes that Bitcoin may have already transcended its role as just a hedge against traditional financial risks and is increasingly resembling a tech stock listed on NASDAQ. In the future, BTC will play a more significant role in investors’ decision-making.

It is also important to note that opportunities and risks coexist going forward. Arthur Hayes’ prediction also includes a significant pullback after a substantial rally. BTC investors should seriously examine the cyclical changes, trade cautiously, and neither miss opportunities nor run out of chips before the peak arrives or lose chips when the tide recedes.

For BTC, which is a long-term high-yield but short-term highly volatile investment, mining BTC is a way for investors to stay in the game and achieve stable returns. Here, BITMARS recommends several ASICs with low shutdown prices and high cost-effectiveness to miners.

The ANTMINER S21 series is the absolute king of energy efficiency ratios among BTC ASICs, and this brand’s machines are comprehensively strong and trusted by miners. Taking the ANTMINER S21 XP 270T as an example, it currently mines about 0.0001512BTC per day, worth about $13.3. When the electricity price is 6 cents, the shutdown price is approximately $34,000.

The WHATSMINER M60/M50, on the other hand, has the advantage of maintaining good working conditions under extreme weather, with the WHATSMINER M60S as a case in point. It has been proven that in the cold weather of North America or in the large diurnal temperature difference of the Middle East, this machine has a very low failure rate, which helps to reduce overall costs. Additionally, its hardware total cost is not high, and it currently mines about 0.00010416BTC per day, easy to payback. When the electricity price is 6 cents, the shutdown price is approximately $46,000. For miners in the Middle East with electricity subsidies, if the electricity cost is controlled at 2 cents, the shutdown price can be as low as $16,000.

Welcome to consult our sellers for the most suitable BTC ASIC and trading methods for you! We have warehouses in HK, US, Dubai, and Moscow, with a large inventory of spot/futures from brands such as ANTMINER/WHATSMINER available for shipping from multiple countries and can assist with customs declarations at the delivery location.

Finally, BITMARS would like to remind everyone that all investments carry risks, so decisions should be made cautiously.

BITMARS is an internationally renowned crypto miner trading company. We provide comprehensive, professional, timely, and cost-effective miner purchasing and hosting services to maximize your wealth!