Is the Legendary S19 About to Make a Glorious Exit? The S21 is Set to Become a Miner’s Must-Have

According to recent data from F2pool, when the price of Bitcoin reaches around $85,000, more than half of the mining machines are already approaching their shutdown price. In the past week, as people realized that the Trump administration’s support for cryptocurrencies did not match their rhetoric, the price of Bitcoin has continued to test lower levels amid minor fluctuations, bringing pressure to miners.

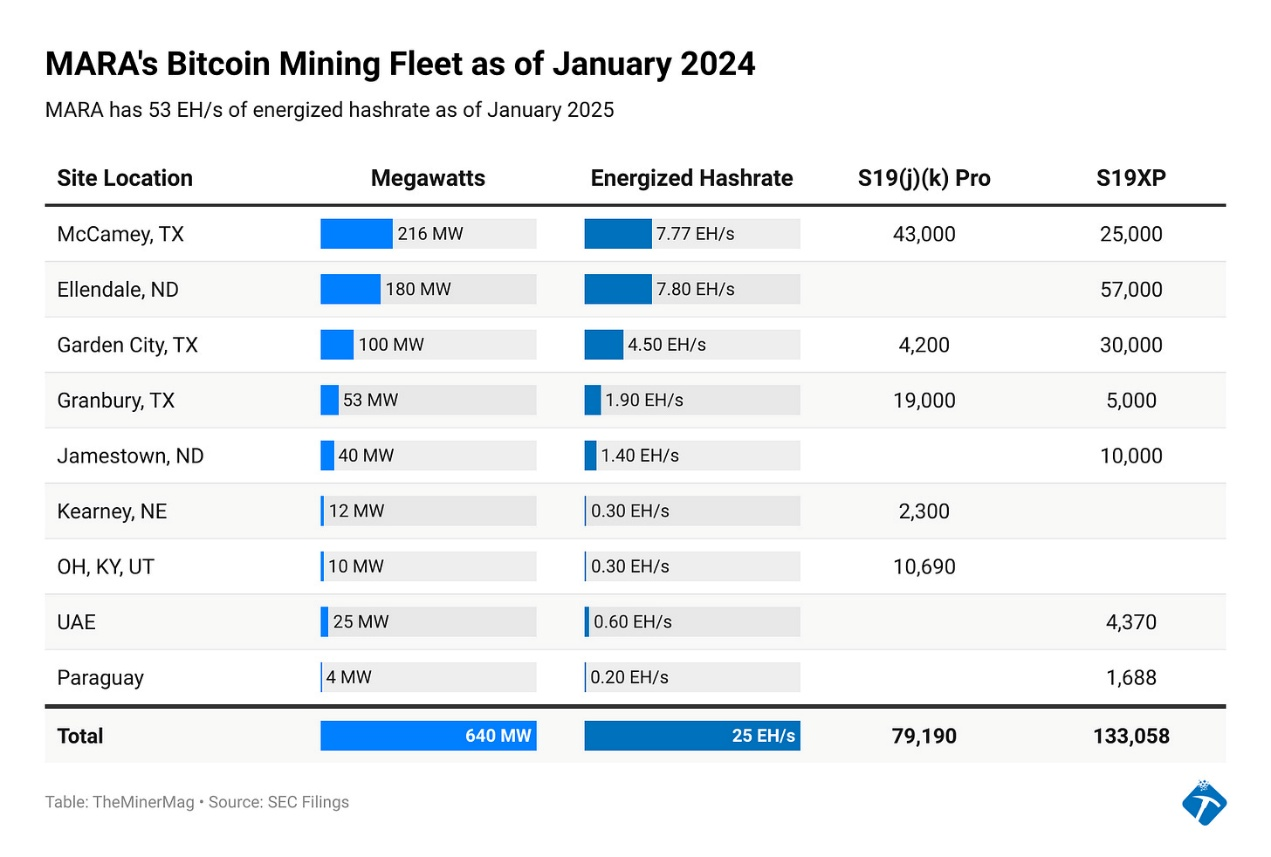

For those familiar with the mining industry, it is well-known that the ANTMINER S19 series, which still accounts for about half of the network’s total hash rate, remains the mainstream machine. This is also confirmed in the report by mining giant MARA. Before the launch of the S21 series by ANTMINER, the S19 had been the most powerful and efficient BTC money-making machine. However, at the current price level, with an electricity cost of 6 cents per kilowatt-hour, the S19 theoretically can hardly generate positive profits.

From past mining experience, we know that when miners shut down their machines on a large scale due to unprofitability, the market often sees a rebound. For example, in December 2018, Bitcoin plunged from $20,000 to $3,150, leading to a massive shutdown of ANTMINER S9 mining machines (with a shutdown price of about $3,500 at that time). In the following six months, the price rebounded to $14,000, a 344% increase. However, in the past two years, with a large influx of traditional capital into the BTC market, whether the price rebounds may no longer be determined by miners’ “strikes,” but rather by the decisions of capital managers.

Therefore, for miners, switching to the higher-hash-rate ANTMINER S21 series is the best choice for a successful future. Soon, miners with high hash rates and low electricity costs will become the most stable and profitable super miners. The S21 is the most suitable model for the current and next stage, and it will help miners embrace a profitable future together.

The ANTMINER S21 series is the absolute king of energy efficiency ratios among BTC ASICs, and this brand’s machines are comprehensively strong and trusted by miners. Taking the ANTMINER S21 XP 270T as an example, it currently mines about 0.0001539BTC per day, worth about $14. When the electricity price is 6 cents, the shutdown price is approximately $34,000.

The WHATSMINER M60/M50, on the other hand, has the advantage of maintaining good working conditions under extreme weather, with the WHATSMINER M60S as a case in point. It has been proven that in the cold weather of North America or in the large diurnal temperature difference of the Middle East, this machine has a very low failure rate, which helps to reduce overall costs. Additionally, its hardware total cost is not high, and it currently mines about 0.00010602BTC per day, easy to payback. When the electricity price is 6 cents, the shutdown price is approximately $47,000. For miners in the Middle East with electricity subsidies, if the electricity cost is controlled at 2 cents, the shutdown price can be as low as $15,700.

Welcome to consult our sellers for the most suitable BTC ASIC and trading methods for you! We have warehouses in HK, US, Dubai, and Moscow, with a large inventory of spot/futures from brands such as ANTMINER/WHATSMINER available for shipping from multiple countries and can assist with customs declarations at the delivery location.

Finally, BITMARS would like to remind everyone that all investments carry risks, so decisions should be made cautiously.

BITMARS is an internationally renowned crypto miner trading company. We provide comprehensive, professional, timely, and cost-effective miner purchasing and hosting services to maximize your wealth!

At BITMARS, we value each client who has come to us, we listen and care what they think. At BITMARS, we never see ourselves as simply a “seller” for miners, we are dedicated to becoming a leading mining solution provider who can bring and create values for our customers’ mining journey.