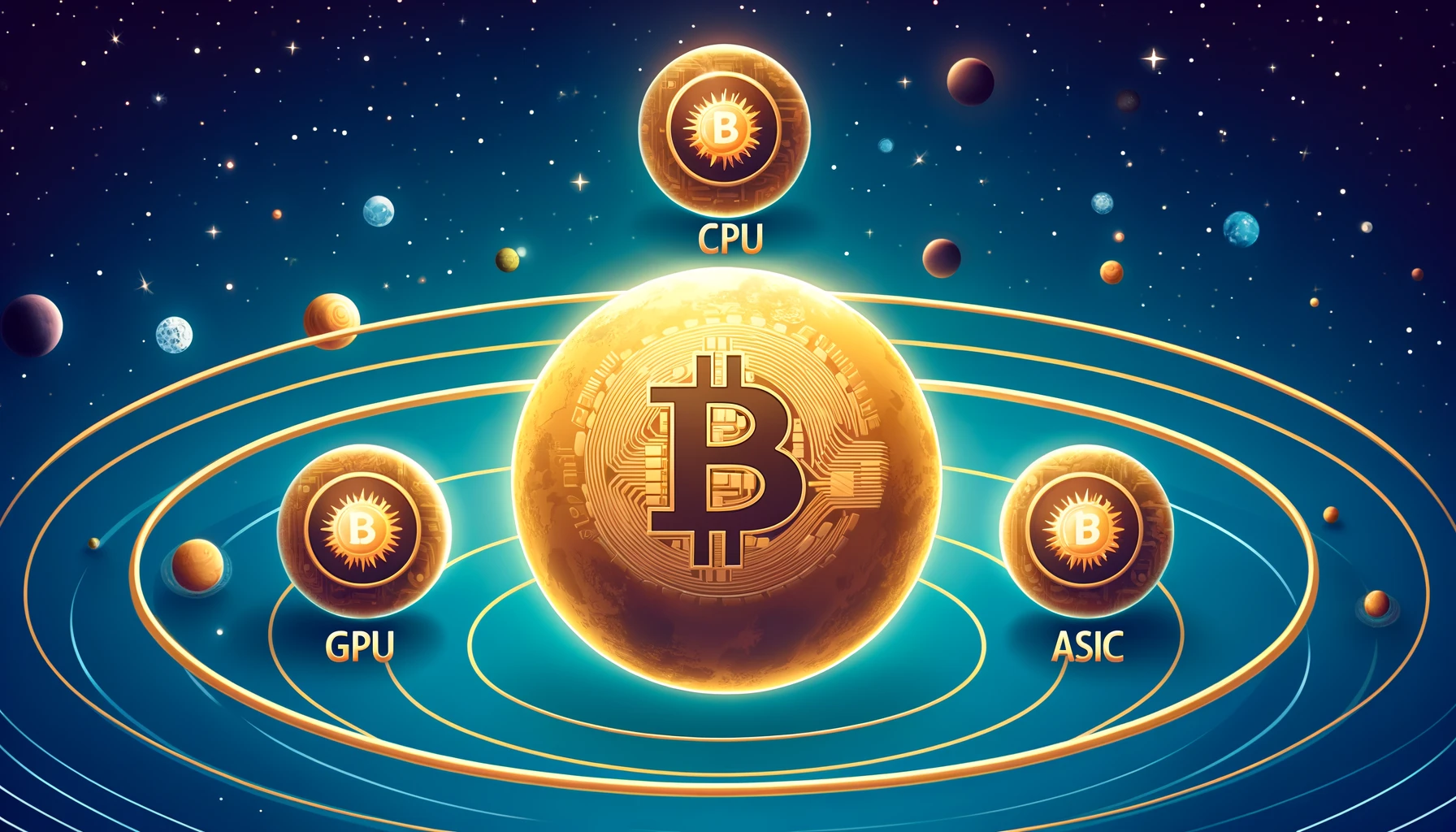

Understanding CPU, GPU, and ASIC Mining: Differences and Relationships

Today, we will introduce the types of mining equipment based on the PoW (Proof of Work) algorithm, including CPU mining, GPU mining, and ASIC mining. All three belong to the category of chip mining, with the latter two being more advanced methods developed from the basis of CPU mining. Each maintains distinct characteristics, making them advantageous in different mining scenarios, hence all three methods are still actively in use. So, what are their historical origins and differences?

We know that “mining” in the cryptocurrency realm refers to using devices with certain computational power to perform calculations through designated algorithms. Initially, the ‘devices with certain computational power’ typically referred to traditional computers with CPUs as the primary computing hardware. Theoretically, our traditional computers could mine any PoW-based cryptocurrency. Some miners might remember the days when Bitcoin was less difficult to mine, and we could easily mine multiple Bitcoins with a regular computer. With the rising value of these cryptocurrencies, miners worldwide sought ways to enhance their devices’ computational power to mine more currency than others, leading to the exploration of GPU mining.

The fundamental difference between GPU and CPU mining is that the former enhances computational capabilities by adding multiple GPUs to a traditional computer setup. This change elevated a mining device’s computational power from tens to hundreds of H/s to thousands of H/s. In the face of much stronger computational power, CPU mining for mainstream currencies became less profitable, and now, almost no one uses CPUs to mine Bitcoin or Litecoin. However, let’s not forget that new cryptocurrencies are always emerging, and the versatility and ease of operation of CPU mining still attract people to mine some new cryptocurrencies. Also, some cryptocurrencies are designed to be CPU or GPU-friendly from the outset, keeping CPU and GPU mining very popular.

Finally, let’s introduce the most powerful mining computers in history—the ASIC miners. With the continuously rising value of certain cryptocurrencies, the business opportunities have attracted institutions to develop computers with special chips designed for mining specific currencies. For example, the antminer s19k pro specifically for mining Bitcoin, the antminer l7 for mining Litecoin and Dogecoin, the antminer ks5 for mining Kaspa coin, etc. Although ASIC miners can only mine specific currencies and have high purchase costs and power consumption, their high profitability still makes them highly sought after by miners. Taking the antminer s21 as an example, it has a computational power of 200TH/s, a million times more than the previous two mining methods. Although the electricity cost of antminer s21 reaches $4-6 per day (assuming 5 cents per kWh), its daily net profit is about $16, with a payback period of approximately 250 days (based on regular data as of March 2024). So, if miners are serious about profiting, ASIC is indeed the best choice for miners. (Miners are welcome to purchase professional ASIC miners at www.bitmars.io)

Here BITMARS briefly summarizes these three different mining methods for miners to easily understand their differences:

| Summary | Hashrate | Power | Consumption Lifespan and Resale Value | |

| CPU Mining | Typically refers to mining with traditional computers. CPUs can theoretically mine any PoW-based cryptocurrency | Generally tens to hundreds of H/s | Usually 100~600W | Depends on hardware maintenance; theoretically can last for many years. Resale based on general computer second-hand valuation |

| GPU Mining | Typically refers to assembled computers with multiple high-performance graphics cards, like the NVIDIA GeForce RTX 3080. GPU mining can theoretically mine any PoW-based cryptocurrency | Generally hundreds to thousands of H/s. The hashrate is tens to hundreds of times that of CPU mining | Usually 100~2000W | Depends on hardware maintenance; theoretically can last for many years. Resale based on general graphics card second-hand valuation. Graphics card prices are heavily influenced by cryptocurrency prices |

| ASIC Mining | Typically refers to professional mining computers with special chips, like the Bitmain-produced antminer s21, designed to mine only specific cryptocurrencies. Normally, ASIC miners are pricier | Can reach several hundred TH/s. The hashrate is a million times that of GPU mining | Usually 500~4000W | Theoretically can last 10 years, but ASIC’s actual lifespan depends on both hardware maintenance and its ability to stay competitive. Its career ends when the machine can’t keep up with profit demands, even if it’s in good condition. During price surges, second-hand machines might sell at higher prices than the original purchase price |

Above is an overview from BITMARS for our miner friends about the relationship and differences between CPU, GPU, and ASIC mining. BITMARS is an internationally renowned cryptocurrency mining machine trading company serving globally. We provide comprehensive, professional, timely, and cost-effective mining machine purchasing and hosting services to maximize your profits!

At BITMARS, we value each client who has come to us, we listen and care what they think. At BITMARS, we never see ourselves as simply a “seller” for miners, we are dedicated to becoming a leading mining solution provider who can bring and create values for our customers’ mining journey.